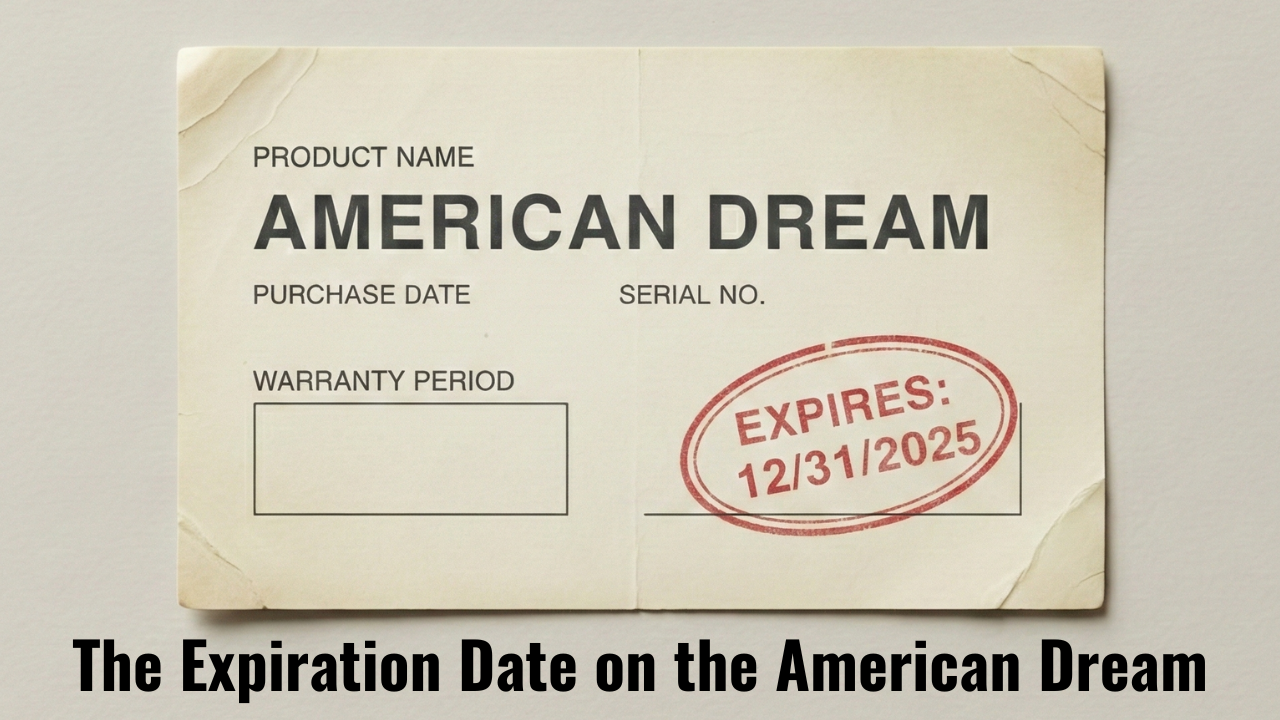

The Expiration Date on the American Dream

Dec 14, 2025

I used to think the American Dream failed with noise. Foreclosure notices. Bankruptcy filings. Addiction spiraling into public collapse. The kind of catastrophe that generates paperwork dramatic enough to earn sympathy. I was wrong.

It expires. It expires the way a warranty does. You keep using the product. You keep following the instructions. Then something breaks and you discover the coverage ran out, even though nothing you did changed.

I am not writing this to complain. Tears are in my eyes, but this is not that kind of story. This is a record of what the American Dream looks like when it does not resolve the way movies promise it will. When the cultural contract expires even though you held up your end.

For most of my adult life, I operated on simple logic. Work hard. Be useful. Honor commitments. Build skill. Show up for people. When money got tight, work more. When systems failed, compensate with effort. That logic held for decades.

I coached tennis for more than thirty years. Not as a side hustle. Immersively. Camps, lessons, programs, travel, parents, kids, pressure. It was never just about forehands. It was stewardship. Being a steady adult inside other families' chaos.

And crucially, it provided elasticity. When money tightened, I could always pull another lever. A clinic. A weekend camp. Private sessions. Additional income of $4,000 to $6,000 per month, sometimes as much as $10,000. There was always more work if I needed it.

Then January 2025 arrived. I had a stroke. It did not kill me. It did not erase my mind. But it removed something essential. It took away that coaching income—the lever that used to restore stability. People call health shocks interruptions. Wrong word. Interruptions imply resumption. This was a boundary.

At the time, I did not understand what that boundary would mean. I focused on recovery. On gratitude. On the work in front of me. A year later, the meaning arrived anyway.

A few weeks ago, I filled out my ACA paperwork for 2026. The quote came back at $1,147.80 per month. In 2025, my premium was about $100 per month. A year ago, that number would have made me flinch. It would not have broken me. I still had the coaching income that could absorb shocks.

Now it landed differently. The math stayed the same, but the margin collapsed. I crossed an income threshold on paper, so subsidies vanished. The system stopped seeing me as someone in transition and started treating me as someone fully solvent. But the income that triggered that reclassification was the same income I no longer had the physical capacity to sustain.

This is not an argument about policy intent. It is about lived effect.

It has no category for people whose earning power got removed by a body that no longer cooperates on demand. It does not taper gently. It flips. That flip matters when a stroke has already taught you bodies don't negotiate.

My expense structure had been set more than a year earlier, based on income I had every reason to believe would continue. The expenses were rational when I set them. Across 2025, reserves dwindled to zero.

Credit cards filled the gap. Not extravagantly. Mechanically. To keep continuity.

At some point, issuers reduced my available credit. Utilization ratios jumped overnight. My credit score fell from the mid-700s to the mid-500s.

I have never missed a payment. I have never been late. The score did not measure trustworthiness. It detected strain. That distinction is not academic when the number decides what options remain available to you.

Earlier this week, I ended up in the emergency room. What both the physician and I feared might be a blood clot turned out not to be. Relief. But something else happened.

At checkout, the person at the front desk paused. He said they needed to go over potential costs. Then he looked at the screen again and said never mind. I had already met my deductibles and copays for the year. The pharmacy confirmed it. Pain medication and muscle relaxers. Zero dollars.

For one brief moment, the system worked the way people imagine it always does. Care without friction. Decisions without financial calculus.

Then the calendar intruded.

In a couple of weeks, it will be January 1. Deductibles and out-of-pocket thresholds reset. If I have another stroke, or need to see a doctor for an AFib incident, or any other event, costs restart. I have ongoing medications because of the stroke.

That was the moment the idea of going uninsured in 2026 finally collapsed. I had considered it seriously. White-knuckling to Medicare eligibility at 65 in February 2027. Hoping nothing catastrophic happened in the meantime. The ER visit made the gamble visible. Hope is not a strategy when time matters.

Then there was the moment that hurt differently. My middle daughter needed her original birth certificate to get a Real ID. Not a copy. The actual document. I mailed it to her. She sent me thirty dollars via Venmo to cover shipping. I had to ask her why.

"Please do not ever give me money like that," I wrote. "Times are tough, but if I cannot mail my daughter her birth certificate without reimbursement, I would feel worse about my situation than I already do." She apologized. She said she misread the message. When I asked her to cancel the payment, she could not. I told her I would put it back in her account.

That exchange was not about money. It was about orientation. Parents absorb friction. Children are not supposed to worry about protecting their parents. She was not doubting me. She was caring. That is what hurt.

All of this has been unfolding while I continue to write about junior athletes and their parents. About the financial and emotional reality of pursuing excellence in sports like tennis. About how costs escalate far beyond what families imagine when they sign up for beginner classes.

I have not found a clean way to be compensated for that work. I keep looking. But I am constrained by something that feels non-negotiable. I do not want to add financial burden to parents already stretched thin. Fear-based monetization is easy. Clarity-based work is harder. I know the machine too well to pretend otherwise.

About a week ago, I talked to a young man documenting his attempt to play collegiate tennis even though he was already halfway through college. I told him he was in the part of the movie where someone with a challenge receives help. That helping hand is happening for him. That is the part audiences like.

What audiences like less is when the final act does not deliver spectacle. When the help arrives but the ending stays ambiguous. When the story resolves into effort rather than triumph. If you are not Michael Oher from The Blind Side, the culture looks away.

Most lives are not three-act structures. They are long, uneven, episodic, and unresolved on any timeline that would satisfy an audience. The American Dream, as marketed, has no language for that.

So this is me telling my story without a soundtrack. Without a guarantee. Without pretending the third act already got written. I am still here. I am still pushing. I am still contributing where I can.

I hope there is a final act that says the effort mattered. That the care mattered. That the push was not foolish. I am hoping for coherence and dignity. Not spectacle. But even if that act arrives quietly, or late, or in a form no one would option for a movie, this is the story I am willing to tell honestly. Not because it flatters me. Because it is true.

Never Miss a Moment

Join the mailing list to ensure you stay up to date on all things real.

I hate SPAM too. I'll never sell your information.